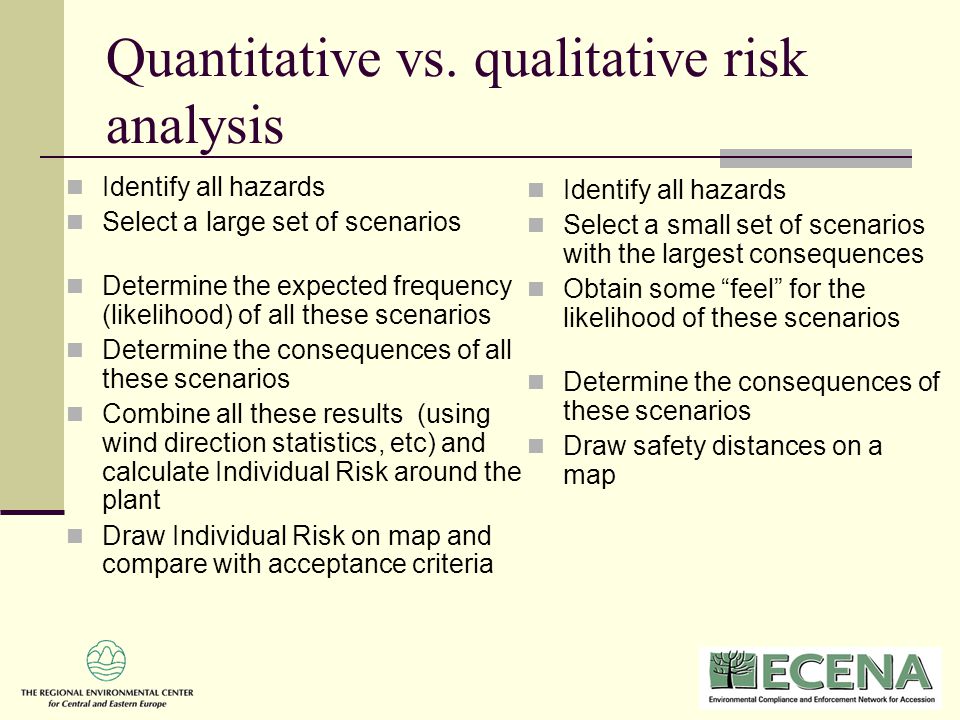

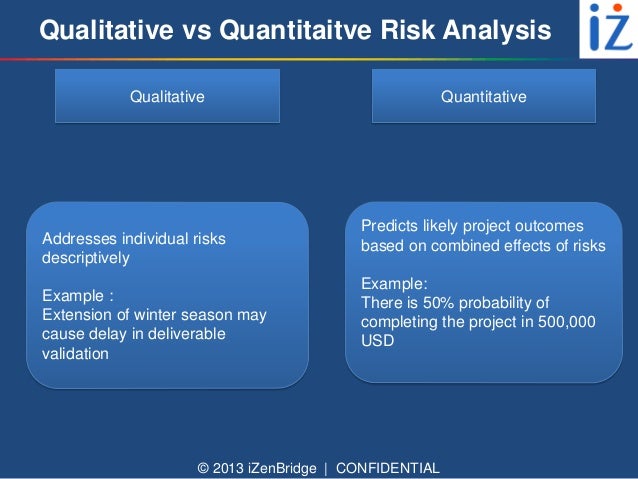

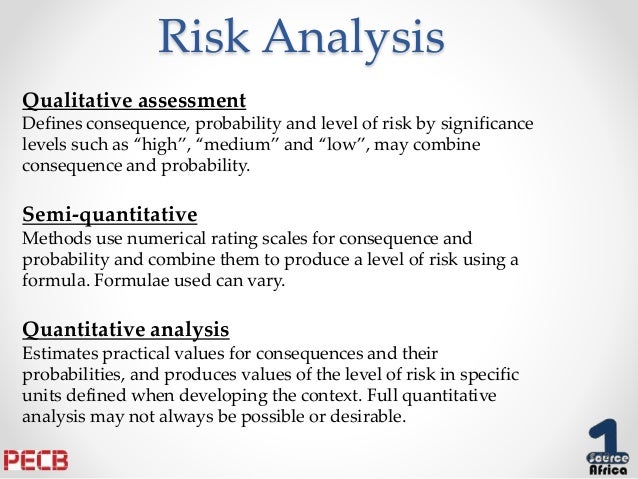

Risk analysis can b e divided

Quantitative Risk Analysis

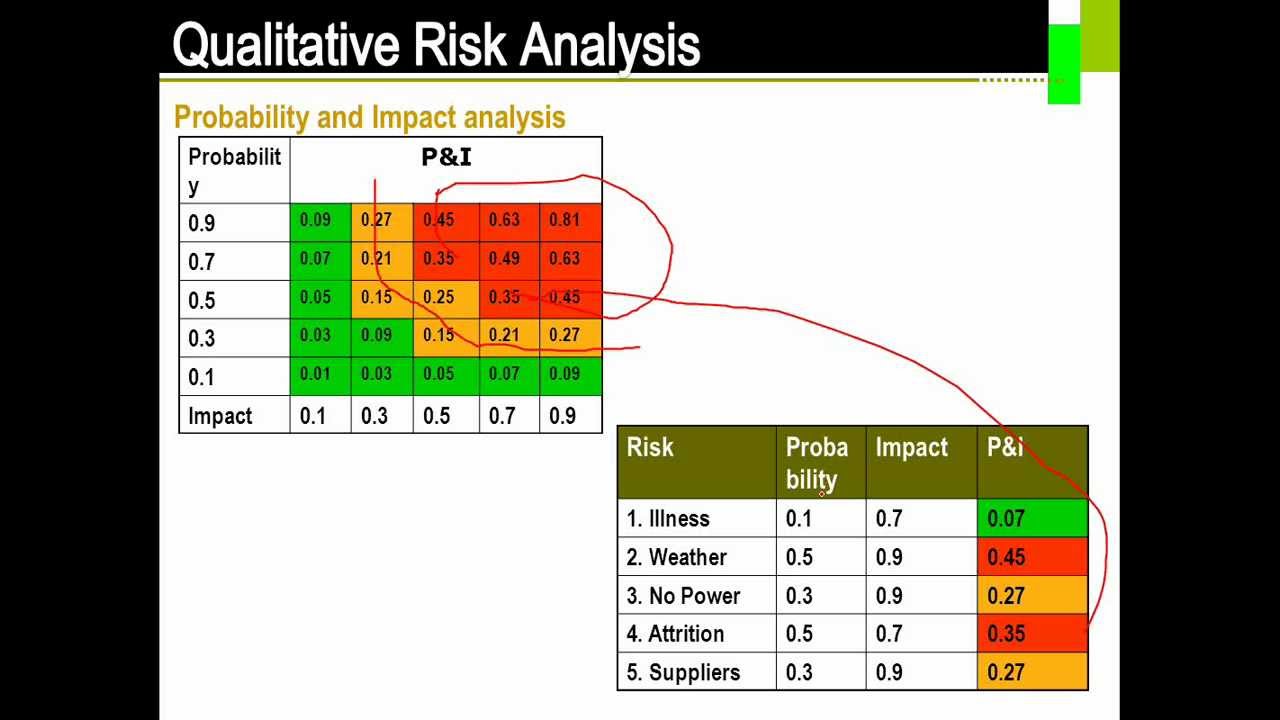

Qualitative Risk Analysis

Quantitative Risk Analysis:

A Quantitative risk analysis attempts to assign an objective are measured

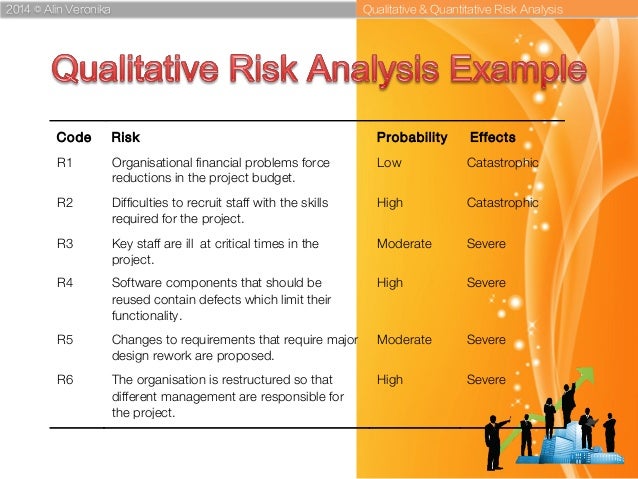

Qualitative Risk Analysis:

A qualitative risk analysis is scenario-driven and doesn’t attempt to analysis

Risk Control is a safeguard or

RISK REDUCTION:

Mitigating risk by implementing the necessary be achieved risk

RISK ASSIGNMENT:

To avoid the outcomes of risk, we can assign the potential loss associated with a risk to a third party, such as an insurance company.

RISK ACCEPTANCE:

It involves the acceptance of the loss associated with a potential risk.

https://resources.infosecinstitute.com/risk-management-concepts/#gref

- Qualitative and Quantitative Risk Analysis

Qualitative or Quantitative?

Understanding Qualitative Risk Analysis

The

Understanding Quantitative Risk Analysis

Quantitative risk analysis is more focused on

http://www.brighthubpm.com/risk-management/33403-qualitative-and-quantitative-risk-analysis/

- Information gathering techniques

Delphi technique

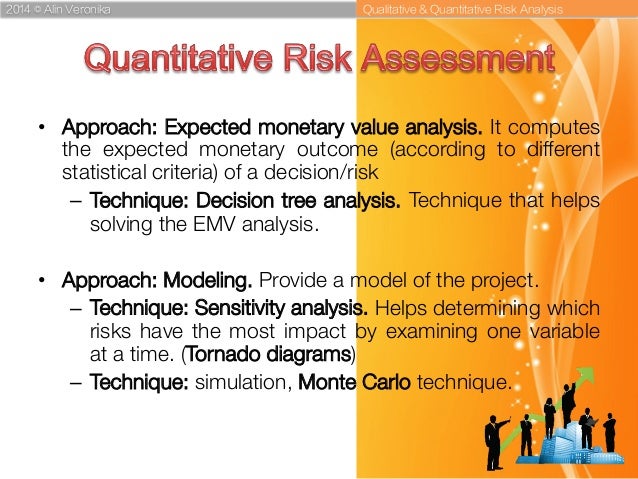

- Calculating Expected Monetary Value (EMV)

Expected Monetary Value analysis (EMV)

Quantitative risk analysis & modeling techniques- commonly used for event-oriented

Expected Monetary Value analysis (EMV)

http://www.clarizen.com/community/clarizen-training-center/how-to-articles/advanced-practices/Risk-Management-Useful-Tools-and-Techniques-how-to.html

Expected Monetary Value is a recommended tool and technique for Quantitative Risk Analysis in Project Risk Management.

Suppose you are leading a construction project. Weather, cost of construction material, and labor turmoil are key project risks found in most

Project Risks 1 - Weather: There is a 25% chance of excessive snow fall that’ll delay the construction for two weeks which will

Project Risks 2 - Cost of Construction Material: There is a 10% probability of the price of construction material dropping, which will save the project $100,000.

Project Risks 3 - Labor Turmoil: There is a 5% probability of construction coming to a halt if the workers go on strike. The impact would lead to a loss of $

though this example is from the construction industry, the theory

In this Expected Monetary Value example, we have two negative project risks (Weather and Labor Turmoil) and a positive project risks (Cost of Construction Material). The Expected Monetary Value for the project risks:

Weather: 25/100 * (-$80,000) = - $ 20,000

Cost of Construction Material: 10/100 * ($100,000) = $ 10,000

Labor Turmoil: 5/100 * (-$150,000) = - $7,500

This means that if the:

Weather negative project risks occurs, the project loses $20,000,

Cost of Construction Material positive project risks occurs, the project gains $10,000, and

Labor Turmoil negative project risks occurs the project loses $ 7,500EMVFinal

The project’s Expected Monetary Value based on these project risks is:

Therefore, if all risks occur in the construction project, the project would lose $17,500. In this scenario, the project manager can add $17,500 to the budget to compensate for this. This is a simplistic Expected Monetary Value calculation example. Another technique used to calculate complex Expected Monetary Value calculations is by conducting Decision Tree Analysis.

http://www.brighthubpm.com/risk-management/48245-calculating-expected-monetary-value-emv/

- Monte Carlo Technique

Modeling and Simulation

http://www.pmpnotes.com/pmp-notes/risk-management/

- What is Monte Carlo simulation?

Monte Carlo simulation is a computerized mathematical technique that allows people to account for risk in quantitative analysis and decision making. The technique

Monte Carlo simulation furnishes the decision-maker with a range of

The technique was first used by scientists working on the atom bomb;

http://www.palisade.com/risk/monte_carlo_simulation.asp

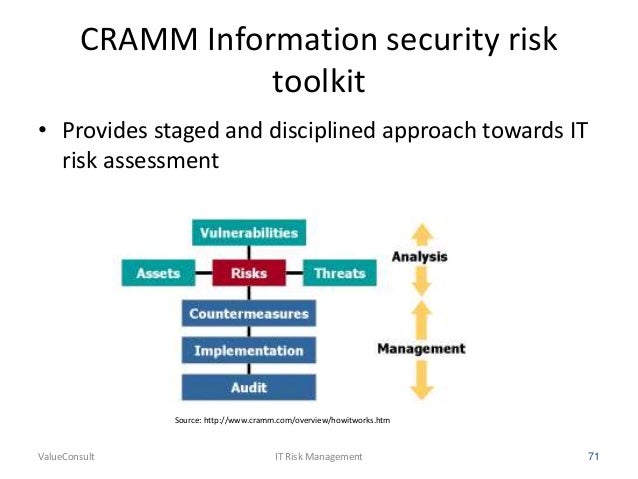

- CRAMM

http://www.cramm.com

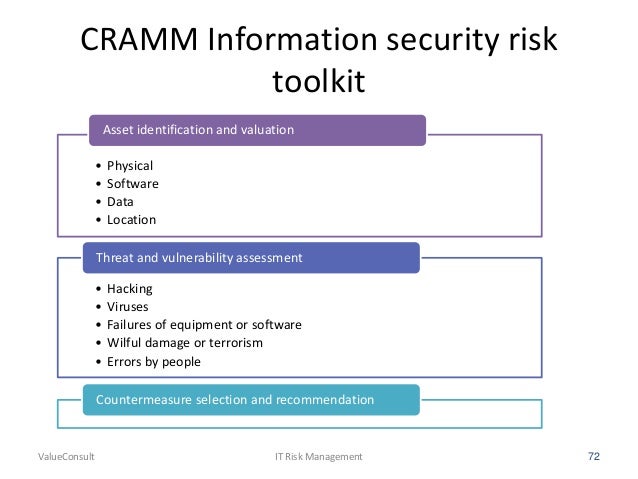

- CRAMM (CCTA Risk Analysis and Management Method) is a risk management

methodology , currently

CRAMM comprises three stages, each supported by

https://en.wikipedia.org/wiki/CRAMM

- CRAMM is a risk analysis method developed by the British government organization CCTA (Central Communication and Telecommunication Agency), now renamed

zhe were based CRAMM is also used

https://www.enisa.europa.eu/topics/threat-risk-management/risk-management/current-risk/risk-management-inventory/rm-ra-methods/m_cramm.html

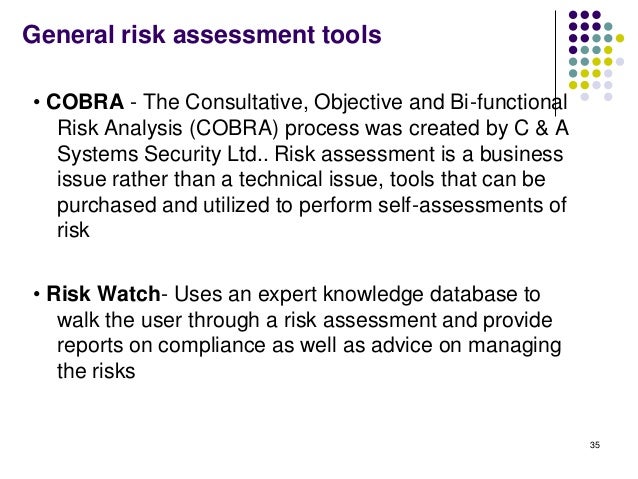

- Cobra software tool enables

security be undertaken evaluates vulnerabilities, be examined stand alone without any be further customized

https://www.enisa.europa.eu/topics/threat-risk-management/risk-management/current-risk/risk-management-inventory/rm-ra-tools/t_cobra.html

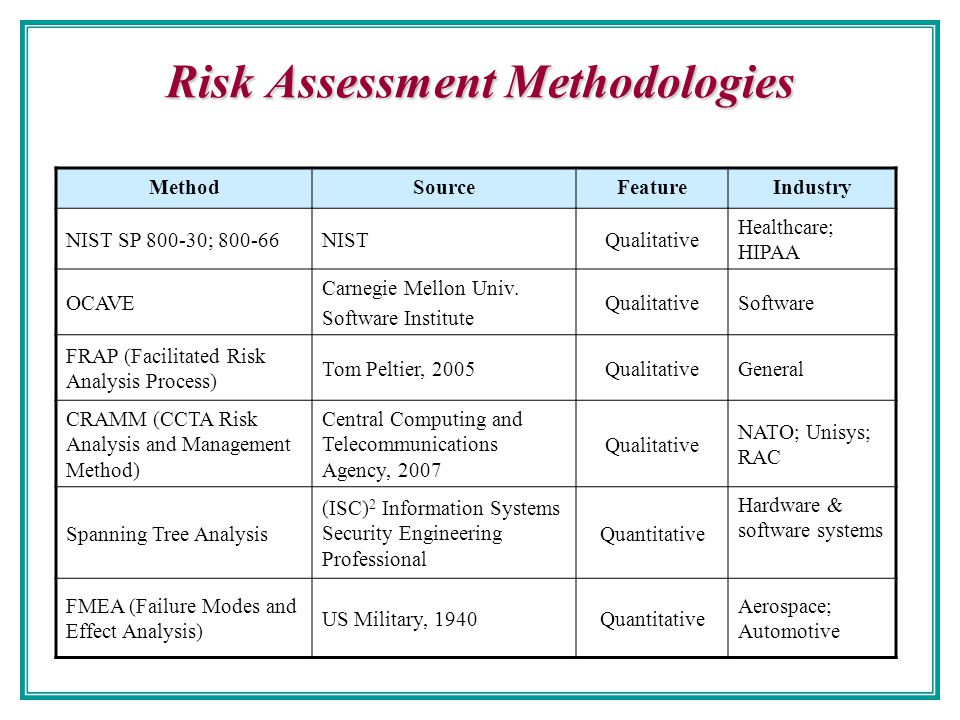

- What Are Some Common Risk Assessment/Management Methodologies and Tools? There are

numerous The following methodologies and tools were developed

•National Institute of Standards & Technology (NIST)

•OCTAVE®

•FRAP

•COBRA

•Risk Watch

7.4 COBRA

https://www.sans.org/reading-room/whitepapers/auditing/introduction-information-system-risk-management-1204

- EAR / Pilar

http://rm-inv.enisa.europa.eu/methods_tools/t_EAR_Pilar.html

- Magerit is an open methodology for Risk Analysis and Management, developed by the Spanish Ministry of Public Administrations, offered as a framework and guide to the Public Administration. Given its open nature it is also used outside the Administration.

Magerit v2 has been structured into three books:

Book I: Methodology. It describes the core steps and basic tasks to carry out a project for risk analysis and management; the formal description of the project; the application to the development of information systems and it provides a large number of practical clues, as well as the theoretical foundations, together with some other complementary information.

Book II: Catalogue of elements. It provides standard elements and criteria for information systems and risk modeling: asset classes, valuation dimensions, valuation criteria, typical threats, and safeguards to be considered; it also describes the reports containing the findings and conclusions (value model, risk map, safeguard evaluation, risk status, deficiencies report and security plan), thus contributing to achieve uniformity.

Book III: Practical techniques. It describes techniques frequently used to carry out risk analysis and management projects such as: tabular and algorithmic analysis; threat trees, cost-benefit analysis, dataflow diagrams, process charts, graphical techniques, project planning, working sessions (interviews, meetings, presentations), and Delphi analysis. The application of the methodology can be supported by the software PILAR / EAR, which exploits and increases its potentialities and effectiveness (PILAR is limited to the Spanish Public Administration. EAR is a commercial product).

https://www.enisa.europa.eu/topics/threat-risk-management/risk-management/current-risk/risk-management-inventory/rm-ra-methods/m_magerit.html

Ebios

http://rm-inv.enisa.europa.eu/methods_tools/t_ebios.html

- Risk Assessment Methodologies

FAIR (Factor Analysis of Information Risk)

NIST RMF (National Institute of Standards and Technology’s Risk Management Framework)

OCTAVE (Operationally Critical Threat, Asset and Vulnerability Evaluation) tools, techniques, and methods that

FAIR (Factor Analysis of Information Risk) is a framework for comprehending, examining and

https://miguelbigueur.com/2015/08/02/risk-assessment-methodologies/#more-864

- SP 800-30 Rev. 1

Guide for Conducting Risk Assessments

The purpose of Special Publication 800-30 is to provide guidance for conducting risk assessments of federal information systems and organizations, amplifying the guidance in Special Publication 800-39.

https://csrc.nist.gov/publications/detail/sp/800-30/rev-1/final

- The goal of risk management is to deliver optimal security at a reasonable cost.

CIA Triad

Confidentiality is about not disclosing sensitive information to other people

Integrity is about preserving the state of the system—we don’t want attackers to change our data

We

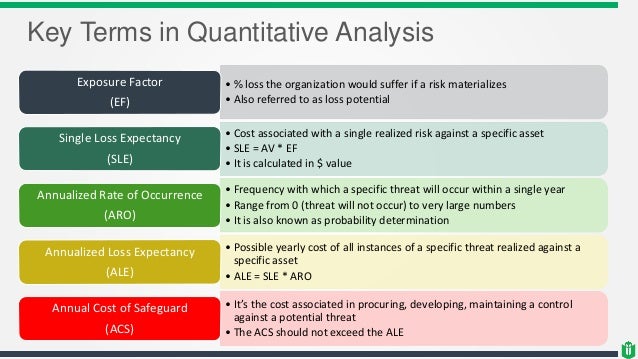

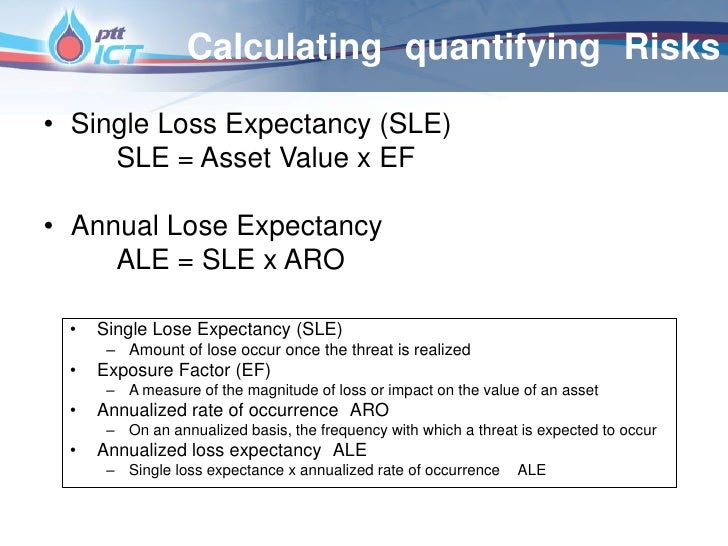

Quantitative analysis is about assigning monetary values to risk components.

Let’s analyze the example of a hard drive failure to better understand how it works.

Let’s first describe the threat, vulnerability, and risk.

Threat—hard drive failure

Vulnerability—backups done rarely

Risk—loss of data

The asset is data. The value of the asset (AV)

Let’s discuss the single loss expectancy (SLE).

It contains information about the potential loss when a threat occurs (expressed in monetary values).

SLE = AV x EF

where EF is an exposure factor

Exposure factor describes the loss that will happen to the asset

SLE is $30,000 in our example when EF

The annualized rate of occurrence (ARO)

ALE = SLE x ARO

ALE is $15,000 ($30,000 x 0.5)

when ARO

Cost/Benefit Analysis

Let’s continue the example from the previous section.

Annualized loss expectancy (ALE) is $15,000.

This means that the potential loss is $15,000 in one year when the data

It happens when the management

This countermeasure should not cost more than $15,000 per year

it wouldn’t be logical from a business point of view (we don’t want to spend more money than we

the annual value of the countermeasure to the company

COUNTERMEASURE_VALUE = ALE_PREVIOUS

ALE_PREVIOUS: ALE before implementing the countermeasure

ALE_NOW: ALE after implementing the countermeasure

COUTERMEASURE_COST: the annualized cost of countermeasure (please note

Risk Handling

Risk reduction—the risk

Risk avoidance—stopping the activity, which leads to the risk

Risk transference—the risk

Risk acceptance—accepting the cost of potential loss (no countermeasures)

Countermeasures

the

three types of countermeasures:

Administrative (e.g., security awareness training should not

Technical (e.g., firewall)

Physical (e.g., locks)

https://resources.infosecinstitute.com/quantitative-risk-analysis/#gref

- Red Hat Enterprise Linux 4

Security Guide

1.2. Security

Physical

Technical

Administrative

These three broad categories define the main objectives of proper security implementation

1.2.1. Physical

Closed-circuit surveillance cameras

Motion or thermal alarm systems

Security guards

Picture IDs

Locked and dead-bolted steel doors

Biometrics (includes

1.2.2. Technical

Encryption

Smart cards

Network authentication

Access control lists (ACLs)

File integrity auditing software

1.2.3. Administrative

Training and awareness

Disaster preparedness and recovery plans

Personnel recruitment and separation strategies

Personnel registration and accounting

https://web.mit.edu/rhel-doc/4/RH-DOCS/rhel-sg-en-4/s1-sgs-ov-controls.html

- Detective Administrative Controls

• Security reviews and audits.

• Performance evaluations.

• Required vacations.

• Background investigations.

• Rotation of duties.

http://www.blacksheepnetworks.com/security/info/

- The annualized loss expectancy (ALE)

is computed

The annualized rate of occurrence (ARO)

ALE = SLE x ARO

The annualized loss expectancy (ALE) is the product of the annual rate of occurrence (ARO) and the single loss expectancy (SLE). It

Suppose that

The annualized loss expectancy is the product of the annual rate of occurrence (ARO) and the single loss expectancy. ALE = ARO *

For an annual rate of occurrence of one, the annualized loss expectancy is 1 * $25,000, or $25,000.

For an ARO of three, the equation is: ALE = 3 * $25,000. Therefore: ALE = $

https://en.wikipedia.org/wiki/Annualized_loss_expectancy

- the annualized loss expectancy for a website against the threat of attack is $82,000

After implementing a new web application firewall, the new annualized loss expectancy would be $20,000

The web application firewall costs $55,000 per year to implement and maintain

single loss expectancy × annualized rate of occurrence = ALE

the value of the web application firewall to the company:

(ALE before

82,000 -20,000 -55,000 = 7000

The web application firewall saves the company in loss expenses:

82000-20000 = 62000

A small office for a company is valued

the single loss expectancy (SLE) for the facility suffering from a fire?

asset value ($600,000) × exposure factor (75%) = $450,000

single loss expectancy (SLE)

asset value × exposure factor (EF) = SLE

- FAILURE MODE & EFFECTS ANALYSIS (FMEA)

https://asq.org/quality-resources/fmea

- FMEA — failure mode and effects analysis — is a tool for identifying potential problems and their impact.

FMEA is a qualitative and systematic tool, usually created within a spreadsheet, to help practitioners

https://www.isixsigma.com/tools-templates/fmea/fmea-quick-guide/

- Information Risk Assessment

Methodology

The ISF’s Information Risk Assessment

https://www.securityforum.org/tool/information-risk-assessment-

- Open Source Security Testing

Methodology

It has been primarily developed methodology It is not meant be used as methodology rather is tailored

OSSTMM rules of engagement

At the beginning of a pentesting the following

Project scope

Confidentiality and non-disclosure assurance

Emergency contact information

Statement of work change process

Test plan

Test process

Reporting standards

OSSTMM channels

OSSTMM test cases cover most of the 10 security domains identified by the International Information System Security Certification Consortium (ISC) They are divided

Human security focuses on assessing personnel security awareness levels and the effectiveness of the security training in the organisation.

Physical security assesses access controls, security processes and physical locations such as buildings, perimeters and military bases.

Wireless communications covers different forms of be intercepted

Telecommunications covers the different communication channels in the organisation, including VoIP, PBX and voicemail

Data networks is the channel which focuses on computer and network security and describes the following activities

Network surveying

Identification

Access process

Service identification

Authentication

Spoofing

Phishing

Resource abuse

OSSTMM uses the concept of modules, defining them as a set of processes or phases which are

The four modules defined by OSSTMM are:

Phase I: Regulatory

Phase II: Definitions

Phase III: Information phase

Phase IV: Interactive controls test phase

https://www.futurelearn.com/courses/ethical-hacking-an-introduction/1/steps/522778

- Threat and Risk Assessment Working Guide

This document entitled Threat and Risk Assessment Working Guide provides guidance to an individual (or a departmental team) carrying out a Threat and Risk Assessment (TRA) for an existing or proposed IT system.

http://www.iwar.org.uk/comsec/resources/risks/itsg-04e.pdf

- Information Security Policy Templates

Is it a Policy, a Standard or a Guideline?

A policy is typically a document that outlines specific requirements or rules that must be met . In the information/network security realm, policies are usually point -specific, covering a single area. For example, an "Acceptable Use" policy would cover the rules and regulations for appropriate use of the computing facilities

A standard is typically a collection of system-specific or procedural-specific requirements that must be met by everyone . For example, you might have a standard that describes how to harden a Windows 8.1 workstation for placement on an external (DMZ) network.

A guideline is typically a collection of system specific or procedural specific "suggestions" for best practice. They are not requirements to be met , but are strongly recommended .

https://www.sans.org/security-resources/policies

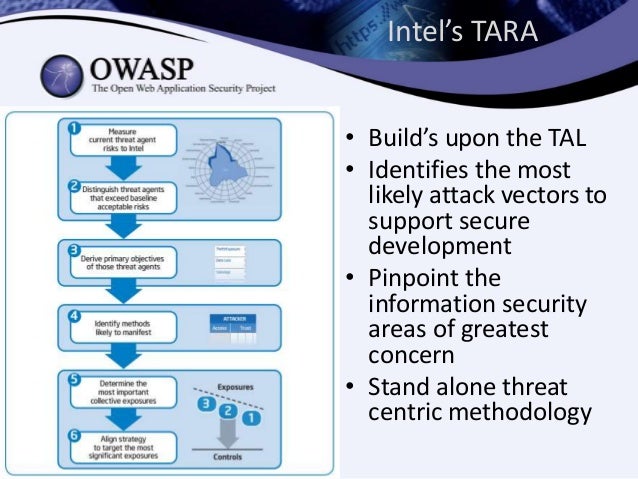

- Top 10 Questions for the Threat Agent Risk Assessment (TARA) methodology

What is the purpose of TARA?

TARA is a method to distill the immense number of possible threats into a manageable picture of the most likely attacks to occur, based upon the objectives and methods of those who possess the capability and desire to do harm.

Why should my organization incorporate TARA?

TARA can help if your organization is challenged with building a practical, accurate, and comprehensive security risk analysis which scales and adapts to the changing risk landscape.

What are the primary benefits of TARA?

I have seen 3 primary areas of benefit.

1. Greatly distilling the cloud of potential attacks, down to a manageable list of likely attacks

2. Improving the quality of risk and control evaluations, to better understand the value of security investments

3. Communicating risks and recommendations to management and non-security audiences

Is TARA a tool, application, device, or checklist?

TARA is a way of analyzing risks (risk of loss) based upon the relationship between attacker’s capability and desire to cause loss, the applicable vulnerabilities, controls, and the residual exposures. The method can be incorporated into risk analysis tools, applications, and processes.

https://itpeernetwork.intel.com/top-10-questions-for-the-threat-agent-risk-assessment-tara-methodology/#gs.1k5alx

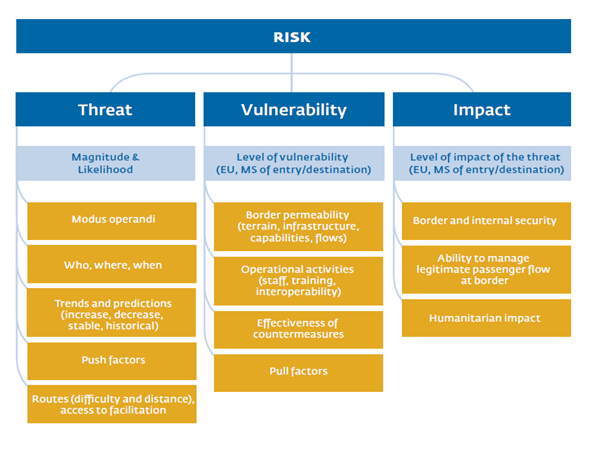

- An asset is what we’re trying to protect.

Asset – People, property, and information.

Threat – Anything that can exploit a vulnerability, intentionally or accidentally, and obtain, damage, or destroy an asset.

A threat is what we’re trying to protect against.

Vulnerability – Weaknesses or gaps in a security program that can be exploited by threats to gain unauthorized access to an asset.

A vulnerability is a weakness or gap in our protection efforts.

Risk – The potential for loss, damage or destruction of an asset as a result of a threat exploiting a vulnerability.

Risk is the intersection of assets, threats, and vulnerabilities.

https://www.threatanalysis.com/2010/05/03/threat-vulnerability-risk-commonly-mixed-up-terms/

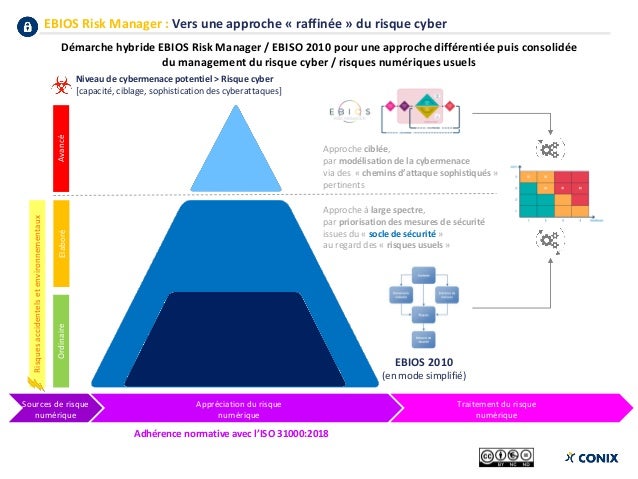

- EBIOS Risk Manager (EBIOS RM) is the method for assessing and treating digital risks, published by National Cybersecurity Agency of France (ANSSI) with the support of Club EBIOS. It provides a toolbox that can be adapted, of which the use varies according to the objective of the project. EBIOS Risk Manager is compatible with the reference standards in effect, in terms of risk management as well as in terms of cybersecurity.

The EBIOS RM method can be used for several purposes:

setting up or reinforcing a management process of the digital risk within an organisation;

assess and treat the risks relating to a digital project, in particular with the aim of a security accreditation;

define the level of security to be achieved for a product or service according to its use cases and the risks to be countered, in the perspective of a certification or accreditation for example.

https://www.ssi.gouv.fr/guide/ebios-risk-manager-the-method/

.jpg)

.jpg)

.jpg)