- Bring your own device (BYOD) (also called bring your own technology (BYOT), bring your own phone (BYOP), and bring your own PC (BYOPC)) means the policy of permitting employees to bring

personally owned mobile devices (laptops, tablets, and smart phones) to their workplace, and use those devices to access privileged company information and applications. Theterm is also used to describe the same practice applied to students usingpersonally owned devices in education settings

http://en.wikipedia.org/wiki/Bring_your_own_device

- What is Bring your own device (BYOD)?

Bring your own device (BYOD) is an IT policy where employees

Unlimited access for personal devices.

Access only to non-sensitive systems and data.

Access, but with IT control over personal devices, apps and stored data.

Access, while preventing local storage of data on personal devices.

http://www.ibm.com/mobilefirst/us/en/bring-your-own-device/byod.html

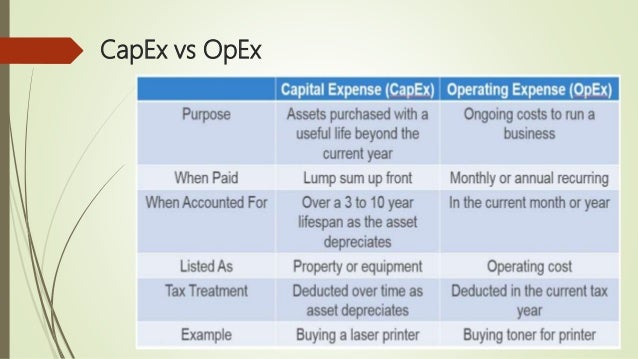

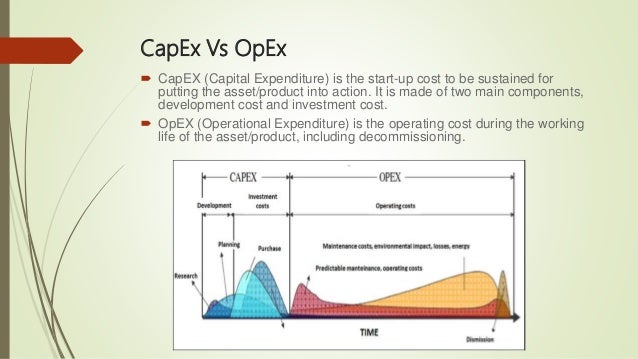

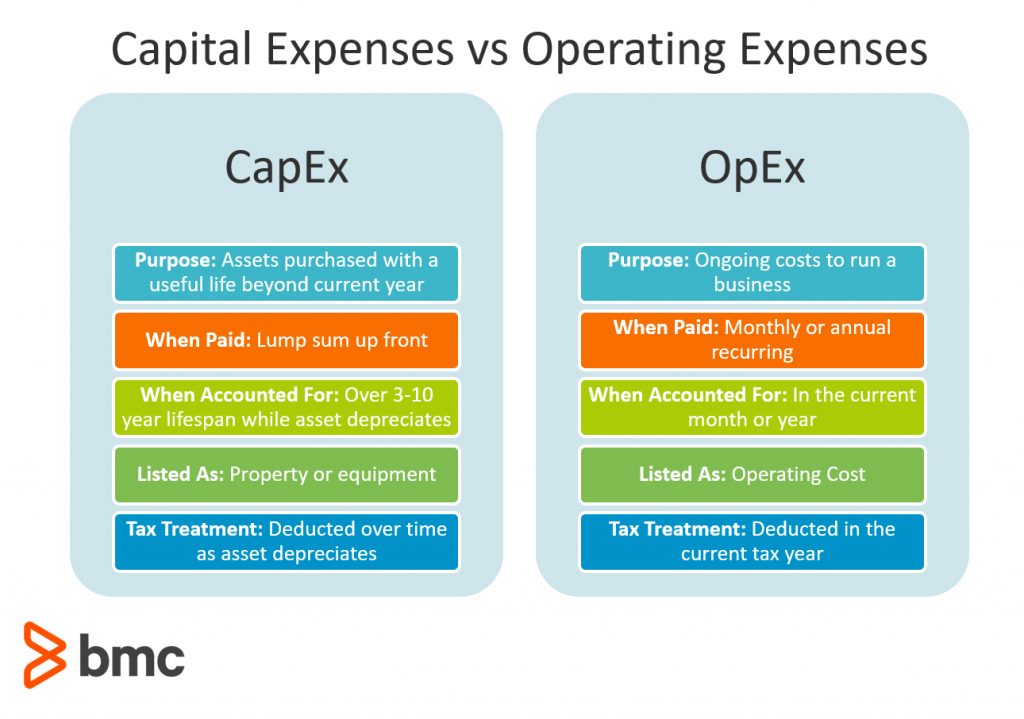

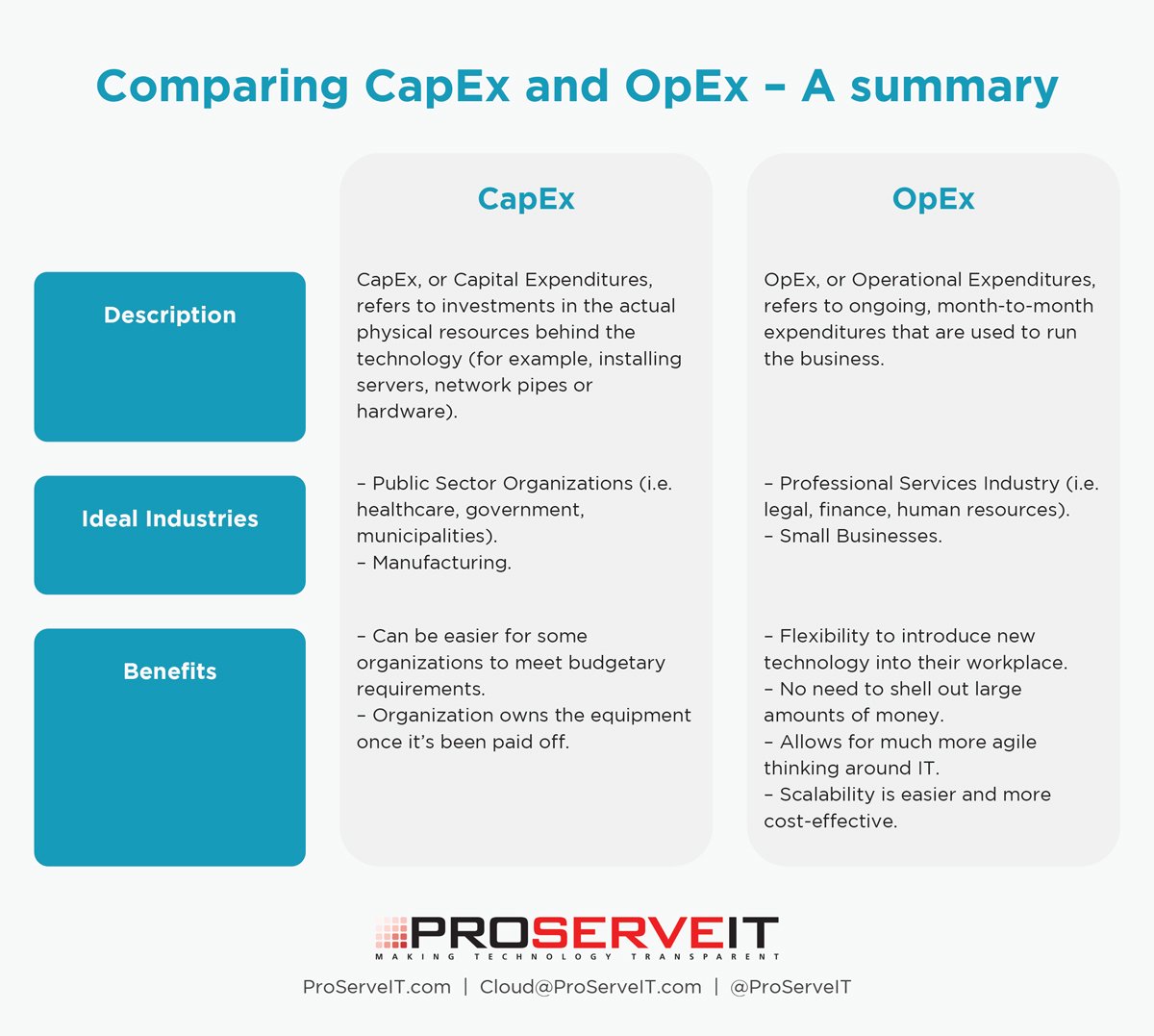

- An operational expenditure (

Opex ) is the money a company spends on an ongoing, day-to-day basisin order to run a business or system.

http://whatis.techtarget.com/definition/OPEX-operational-expenditure

- A capital expenditure (Capex) is money invested by a company to

acquire or upgrade fixed, physical, non-consumable assets, such as buildings and equipment or a new business.

http://whatis.techtarget.com/definition/CAPEX-capital-expenditure

- What is CapEx and

OpEx ?

CapEx refers to a Capital expenditure while

Operational expenditure

How CapEx and

CapEx

OpEx

CapEx Summary

Purchase of fixed assets.

Preparation of the purchased asset so it can be appropriate for business use.

Fixing of

Restoration of an asset’s value through upgrading

Adapting a machine to a different use

Operating Expenditures Summary

License fees

Advertising costs

Legal and attorney fees

Telephone and power overheads

Insurance fees

Property management costs

Property taxation expenses

Vehicle fuel and repair costs

Leasing commissions

Salary and wages

Raw materials and supplies

Office overheads

IT Spending

Traditionally technology investments most often

https://www.comindware.com/blog-what-is-capex-and-opex/

- A COTS (commercial off-the-shelf) product is one that

is used "as-is."COTS products are designed to be easily installed and tointeroperate with existing system components. Almost all software bought by the average computer user fits into the COTS category: operating systems, office product suites, word processing, and e-mail programs are among the myriad examples. One of the major advantages of COTS software, which is mass-produced, is its relatively low cost.

http://searchenterpriselinux.techtarget.com/definition/COTS-MOTS-GOTS-and-NOTS

- A COTS product is usually a computer hardware or software product tailored for specific uses and made available to the

general public.Such products are designed to be readily available and user friendly. A typical example of a COTS product is Microsoft Office or antivirus software. A COTS product isgenerally any product available off-the-shelf and not requiring custom development before installation

http://www.techopedia.com/definition/1444/commercial-off-the-shelf-cots

- proof of

concept (POC)

When a company

For example, a company interested in developing a new suite of software would look at market demand, feasibility of the project, projected cost, and other factors.

http://www.wisegeek.com/what-is-a-proof-of-concept.htm

No comments:

Post a Comment